SECURE YOUR SUCCESS

Getting out in front of risk has its rewards.

Achieving success is one thing. Securing it is another. At Marshall+Sterling, we’re driven to help you reach your business and lifestyle goals—and protect them as the future unfolds.

What We Do

Minimize risk.

Maximize success.

Marshall+Sterling is an independent agency focused on protecting clients with customized business insurance, employee benefits, personal insurance, equine insurance, and wealth management services.

Business Insurance

The world is full of uncertainty. Marshall+Sterling’s business insurance and risk management experts customize plans to help safeguard your business.

Employee Health and Benefits

Marshall+Sterling’s employee benefits experts design and implement compliant benefits programs to fit your business’s needs, culture, and strategic plan.

Personal Insurance

Whether for your home, auto, recreational vehicles, or life and health, we have solutions to protect you from whatever life throws your way.

Retirement and Wealth

Dedicated to simplifying the complexities of the financial world and supporting you in achieving and protecting what matters most.

Equine Insurance

Our Equine Division specializes in personalized plans that encompass a full range of equine, farm, and ranch insurance coverage.

Why Marshall+Sterling?

The Marshall+Sterling difference.

Our vision, purpose, and core values are at the forefront of all that we do. We invest heavily in talent and technology to continually drive our leading principles as we advance our service delivery and the guidance we provide our clients. Learn more about how we are remaining on the vanguard.

“Marshall+Sterling has always been there when I needed help with insurance for a new building project, landlord insurance, or getting competitive rates for homeowner’s insurance. The local agents are fast, helpful, and professional.”

Shannon, Poughkeepsie, NY

Experience

Marshall+Sterling has 160 years of experience working across a range of industries.

People

You are supported by a dedicated team of risk protection and claims experts.

Process

Our customer-focused planning is based on your unique needs and risk tolerance.

Tools

We use state of the art analytics and predictive modeling to glean actionable insights.

Culture

Marshall+Sterling is employee-owned, which means we’re invested in your success.

“There is a great team oriented feeling, but at the same time I am given the independence and leeway that makes me feel like the owner of my own business.”

Matt Cronin, Sales Management

Careers

Join our growing team.

We’re creating a culture where creative, motivated, and caring people come together to build something meaningful. Build your career at one of the largest employee-owned independent agencies in the nation.

Explore our latest insights.

-

Spring Checklist

Punxsutawney Phil decreed 6 more weeks of winter about 5 weeks ago, so if you haven’t already, it’s time to get ready for spring—and here are some tips and resources to help! Horse Health VaccinesTypical annual care vaccines throughout the US include Rabies, Tetanus, WNV (West Nile Virus) and EEE/VEE […]

-

NYS Managed Care Organization Tax

The Centers for Medicare and Medicaid Services (CMS) recently approved New York’s Managed Care Organization tax (MCO), effective January 1, 2025. This new tax on health plans, authorized by the NYS 2025 Budget, aims to enhance state Medicaid funding. The tax will apply at varying rates based on plan type […]

-

Cyber Insurance for the Construction Industry: Why It’s Worth the Investment

In a recent Travelers Insurance Group construction industry survey, participants ranked cyber threats as their top concern for the fourth time in six years. Despite these concerns, contractors still lag behind when it comes to either purchasing Cyber Insurance or being proactive in fighting Cyber incidents. Despite 80% of respondents […]

-

Changes to ACA Reporting Rules for 2025

This article is of interest to Applicable Large Employers (ALEs) – generally those with 50 or more full-time employees (including full-time equivalent employees). Under the ACA’s employer shared responsibility (“Pay or Play”) provisions, large employers may be subject to a penalty if they do not offer affordable coverage that provides […]

-

2025 New Year’s Resolution – Get Horse Insurance!

For many of us, 2024 has been a wild ride. So after taking a collective sigh of relief, let’s get started making a plan for 2025! If the last few years have taught us anything, it is to prepare for the unexpected. That being said, no one wants to hang […]

-

New York Employers Should Prepare for New Labor Laws Starting January 1, 2025

New York employers should begin to prepare for important new labor laws that will take effect on January 1, 2025. Wage and Hour Increases Effective January 1, 2025 New York City, Westchester, and Long Island The general minimum wage rate will increase to $16.50 per hour. Additionally, the minimum salary […]

-

Federal Court Vacates DOL’s Final Overtime Rule Nationwide

On Nov. 15, 2024, the U.S. District Court for the Eastern District of Texas vacated the U.S. Department of Labor’s (DOL) final rule to amend current requirements that employees in white-collar occupations must satisfy to qualify for an overtime exemption under the Fair Labor Standards Act (FLSA). This ruling sets […]

-

Winter Equine Safety

For many of us, winter brings with it a not quite delightful menu of snow, ice, mud, and cold temperatures, all of which lead to unique horse management challenges. Consider the following scenarios to ensure you and your horse have a safe and healthy winter season. Scenario #1 – The […]

-

Understanding Insurable Interest in Horse Insurance Policies: Leases, Horses on Trial, Purchases over Time Insurance Policies

Leases, Horses on Trial, Purchases over Time The concept of insurable interest is a common topic in equine insurance, especially when clients are working on insuring a horse that they lease, are taking on trial, or purchasing over time. In a nutshell, for a party to have an insurable interest […]

our Community

Making a difference where we work and live.

Our values drive us and our people inspire us. We are committed to being a strong regional partner and playing a key role within the communities we serve.

our history

We have served you for over 160 years, and we’re still going strong.

Since 1864, Marshall+Sterling has been the name synonymous with outstanding insurance coverage and customer service.

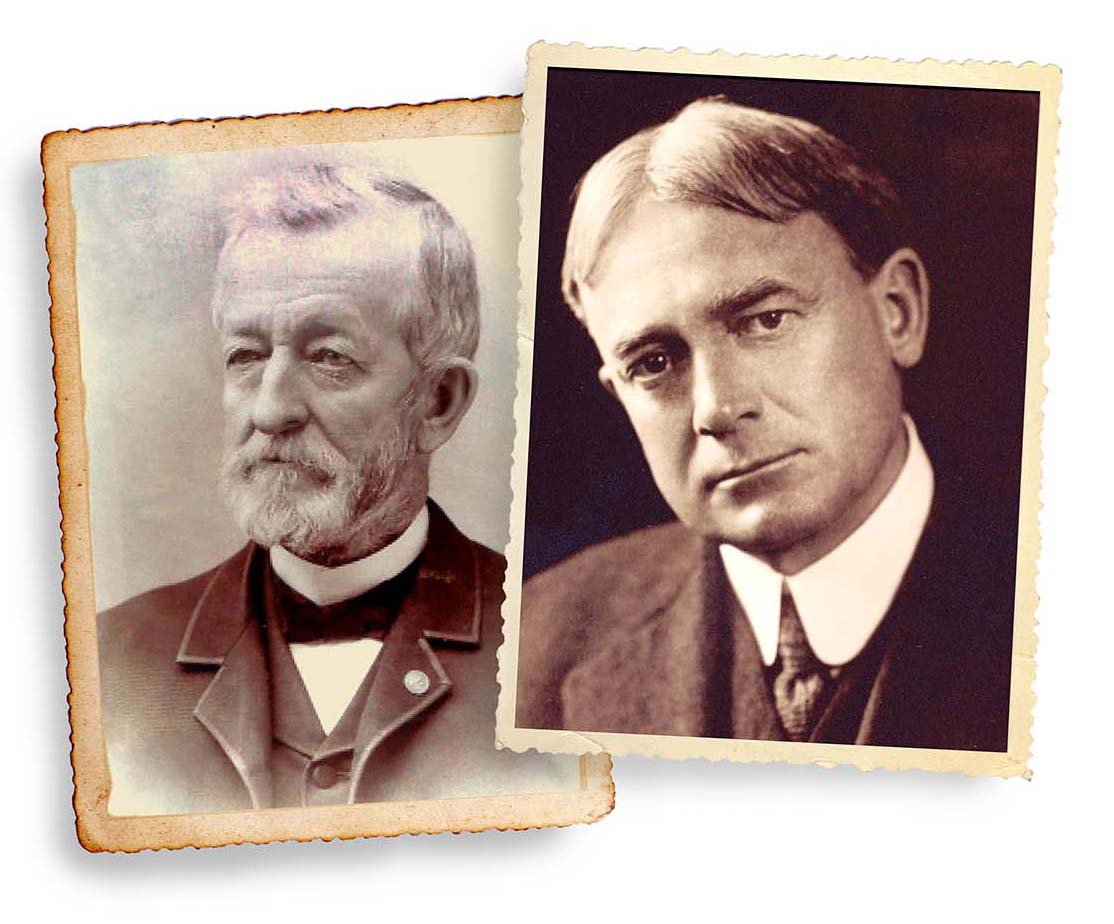

At left: Joseph H. Marshall and Graham L. Sterling.

At left: Joseph H. Marshall and Graham L. Sterling.

Contact Us

We’re here to help secure your success.

Whether you are looking for employee benefits plans; insurance for your business, home, auto or personal effects; or wealth management and financial planning services, we provide a comprehensive set of services to help you achieve success the way you define it.

Marshall+Sterling by the numbers.

#36

largest independent US insurance brokers

100%

employee-owned business

$1B+

in written premiums

200+

insurance carriers

represented

500+

professionals

160

years of service experience

22K

clients served